Where is the market finding joy? Is it here, in the Russell 2000 (IWM)? Let’s check out the weekly chart.

The 50-week moving average just crossed below the 200-week moving average. That is bearish. The Leadership Indicators shows IWM well underperforming the SPY; also bearish. The Real Motion Momentum Indicator is in a bearish phase at the moment as well, albeit with some signs of oversold conditions.

This weekend’s Outlook pointed out that “There are far too many disjointed economic scenarios playing out. These are all meaningful problems that could have a serious impact on the financial condition of the U.S.”

Our Risk Gauges are Risk-Off for the most part. Even with Monday’s rally, sectors like Retail (XRT) and Transportation (IYT) are weak. So where is the joy?

Our Sister Semiconductors is the bright spot. The opposite of her Granddad IWM, she is in a weekly bullish phase. SMH is outperforming the SPY.

One caveat, however — the Real Motion momentum indicator is in a bearish phase with momentum just skimming along the 50-WMA. Keep that in mind.

Add our Big View Indicator and it says:

Risk-On

Value stocks (VTV) have gotten crushed last week when compared to Growth stocks (VUG) on a relative basis. VUG has reclaimed a bullish phase similar to the Nasdaq, while VTV is now underperforming relative to the rest of the US Market. (+)

Neutral

US Indices are showing a confused picture, with QQQ reclaiming a bullish phase on both a daily and weekly timeframe. In contrast, the other 3 key indices continued to sell off and close under their 200-day moving averages and in Distribution phases. (=)

What happens next? Perhaps SMH is telling us that, whilst IWM holds the December lows, the market can still rally. Or perhaps the “tech saves the day” trade, whilst still the future, got a bit too ahead of itself, and the FOMC can bring everything tumbling down.

Everything except inflation. We still believe that will persist.

Here is a look at this week’s economic data on tap:

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

IT’S NOT TOO LATE! Click here if you’d like a complimentary copy of Mish’s 2023 Market Outlook E-Book in your inbox.

“I grew my money tree and so can you!” – Mish Schneider

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

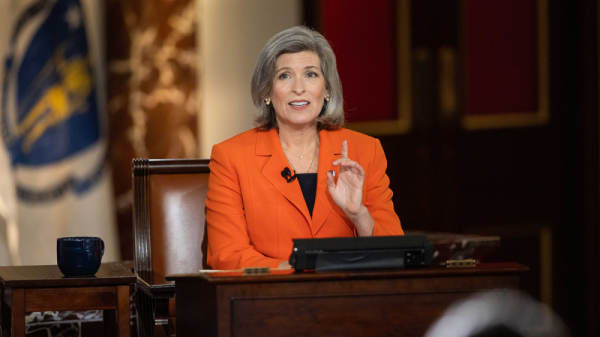

Mish sits down with Kristen on Cheddar TV’s closing bell to talk what Gold is saying and more.

Mish and Dave Keller of StockCharts look at longer term charts and discuss action plans on the Thursday, March 17 edition of StockCharts TV’s The Final Bar.

Mish covers current market conditions strengths and weaknesses in this appearance on CMC Markets.

Mish sees opportunity in Vietnam, is trading SPX as a range, and likes semiconductors, as she explains to Dale Pinkert on ForexAnalytix’s F.A.C.E. webinar.

Mish and Nicole discuss specific stock recommendations and Fed expectations on TD Ameritrade.

Coming Up:

March 20th: Twitter Spaces with LiatheTrader and Wolf Financial

March 22nd: The RoShowPod with Rosanna Prestia

March 24th: Opening Bell with BNN Bloomberg

March 30th: Your Daily Five, StockCharts TV

March 31st: Festival of Learning Real Vision “Portfolio Doctor”

April 24-26: Mish at The Money Show in Las Vegas

May 2-5: StockCharts TV Market Outlook

ETF Summary

S&P 500 (SPY): 390 pivotal.Russell 2000 (IWM): Still weak comparatively–170-180 range now.Dow (DIA): 310 support, 324 resistance.Nasdaq (QQQ): 328 is the 23-month MA resistance, 300 support.Regional Banks (KRE): 44 support, 50 resistance–still looks like lower in store.Semiconductors (SMH): 255.64 last month’s high, 248 nearest support.Transportation (IYT): Clutch-hold 218 if this market is to hold.Biotechnology (IBB): 2 inside days and at resistance–interesting sector. Retail (XRT): 60 big support, 64 big resistance.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education