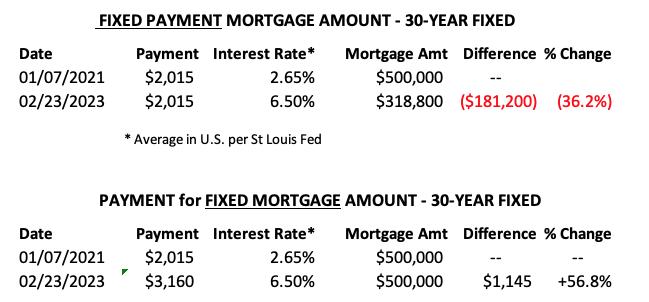

We watch the 30-Year Fixed Mortgage Interest Rate, because, for the most part, people buy homes based upon the maximum monthly payment they can afford. As rates rise, a fixed monthly payment will carry a smaller mortgage amount. As buying power has been shrinking, home prices have come under pressure.

This week the 30-Year Fixed Rate rose from 6.32 to 6.50. The following table shows that, since the historic low in the 30-Year Fixed Rate mortgage, the same monthly payment can only service a mortgage that is one-third smaller than in January 2021. Or the same size mortgage ($500,000) will require a payment that is 56.8% higher.

This chart shows that rates are back to about where they were at the start of the Financial Crisis.

I hear a lot of gnashing of teeth about high interest rates, but when we bought our first home in 1964, the interest rate was 7.25%. When we bought our present home in 1972, the interest rate was 7.25%, so 6.5% seems pretty good to me.

The chart below shows the explosion of rates in the 1970s and 1980s. I don’t know how today’s inflation compares to that period, but it does demonstrate how bad things can get if inflation is not tamed.

CONCLUSION: Current interest rates are, in my opinion, somewhat normal with the exception of the inversion. I hear fantasies about when the Fed can start to cut, but cutting rates could just send up back to where the current inflation troubles began.

Watch the latest episode of DecisionPoint on StockCharts TV’s YouTube channel here!

Technical Analysis is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2023 DecisionPoint.com

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.