Preliminary earnings numbers are in for 2022 Q3. To clarify, earnings results are collected for the three months after the end of the quarter. “Earnings season,” the collection period for 2022 Q4, has just begun.

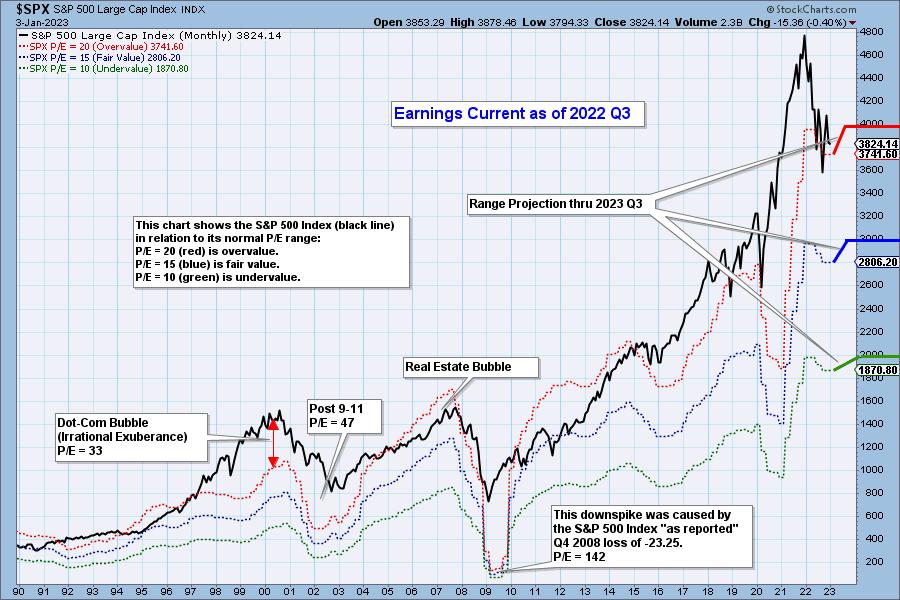

The chart below shows the normal value range of the S&P 500 index ($SPX), indicating where $SPX would have to be to have an overvalued price/earnings (P/E) of 20 (red line), a fairly valued P/E of 15 (blue line), or an undervalued P/E of 10 (green line). Annotations on the right side of the chart show where the range is projected to be based on earnings estimates through 2023 Q3.

Historically, price has usually remained below the top of the normal value range (red line). However, since about 1998, it has not been uncommon for price to exceed normal overvalued levels, sometimes by a lot. The market has been mostly overvalued since 1992, and it hasn’t been undervalued since 1984. You could say that this is the “new normal,” except that it isn’t normal by Generally Accepted Accounting Principles (GAAP) standards.

The table below shows earnings projections through September 2023 using GAAP earnings as the basis for the analysis. Keep in mind that the P/E estimates are calculated based on the $SPX close as of December 30, 2022. Keep in mind, the numbers will change daily depending on where the market goes from here. It is notable that the P/E is again outside the normal range.

The following table shows where the bands are projected to be based on earnings estimates through 2023 Q3.

This DecisionPoint chart keeps track of S&P 500 fundamentals, P/E, and yield. It’s updated daily—not that you need to watch it that closely, but it is up-to-date when you need it.

The Takeaway

The market is still overvalued and slightly above the normal range. As the bear market progresses, I expect actual earnings will fall short of estimates, and that prices will continue to fall. I would like to see the S&P 500 get back to the undervalued level, which I’m sure will happen when pigs fly. Falling prices will help that happen, but falling earnings will cause the value range to move lower, making it harder to reach undervalued levels.

Watch the latest episode of DecisionPoint on StockCharts TV’s YouTube channel here!

(c) Copyright 2023 DecisionPoint.com

Technical Analysis is a windsock, not a crystal ball.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)