The elephant in the room is the implosion of crypto exchange FTX and the potential contagion effect of its demise. It seems that very large investors, including some of Wall Street’s biggest public names, had a stake in FTX, and that their investments have literally disappeared along with those of the unsuspecting public who ponied up their savings.

According to CNBC, the newly appointed CEO of the now bankrupt exchange, John Ray, who managed the Enron bankruptcy, noted in a court filing that “in his 40 years of legal and restructuring experience,” he had never seen “such a complete failure of corporate controls,” and a “complete absence of trustworthy information.” There is no way to know how many off-the-book derivative bets connected to FTX are out lurking.

Where it gets personal for the stock market is if, in the usual course of business, when margin calls for those derivatives emerge and the losing side has to sell stocks to pay off the bet. The other issue is whether there are there going to be certain parties who will default; if so, how big will they be and how will the dominoes fall?

So far, there have been no reports of anyone of any importance not meeting their obligations. But of course, that could change, as the amount of money that evaporated keeps growing – a billion here, a billion there; who’s counting? Moreover, with the Fed still talking tough and likely to raise interest rates again in December, just about anything could happen if there are defaults and the central banks continues with its rate hikes.

Meanwhile, the market’s breadth, as I describe below, is starting to resemble what we saw in the late summer after that short-covering rally ran its course, as some investors are getting cold feet. At the same time, even though FTX is quietly expanding into what could be a black hole of some importance, the Fed’s out on the talk circuit again with Fed Governor Mary Daily noting on CNBC that there is no reason to “pause” raising rates with the 4.75% to 5.25% range seeming “reasonable.” That means some at the Fed are looking for another 1.25% higher than the current levels. This was followed by more hawkish talk from the Fed’s Bullard on the next day, which pushed stocks lower. He alluded to the possibility of rates moving as high as 5-7%.

And yes, I could be wrong because of the strong seasonal tendency for the market to rally in November to January, especially in the prelude to the third year of the Presidential Cycle. Still, it’s starting to look as if the closer we get to the December FOMC meeting, we’ll get more hawkish talk, followed by action in December where at least a 0.5% increase in the Fed Funds is all but baked in.

All of which leads me to repeat what I noted here last week: “We’ll see how long this rally lasts.”

Fed’s Hawkish Tone Extends Bond Market Rally

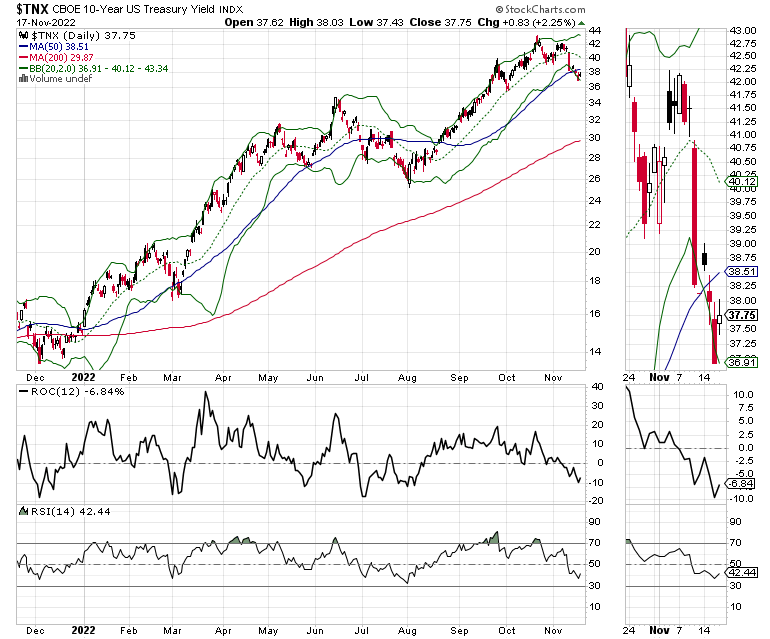

The Federal Reserve’s hawkish tone, as highlighted above, delivered a setback to the stock market. On the other hand, it extended the bullish tone in the bond market as the U.S. Ten Year Note yield (TNX) drifted closer to the 3.5% yield range.

The price chart suggests that the bond rally may pause in the short term. But it’s still a sizeable move, which will work its way through the economy, especially if it lasts.

The action in bond land accomplishes two things. One, it validates the notion that inflation may have peaked, although it’s not certain that this is true by any means. But the bond trading algos think so, thus (tongue in cheek) it must be true.

Sarcasm aside, if the bond algos are right and inflation has topped out, then the Fed will do what it always does; it goes too far when it jiggers interest rates. And if that’s the way things eventually work out, then the odds of a real recession are rising by the minute. This is especially prescient to note when layoffs are rising, retailers are missing their sales expectations (think Target, TGT), homebuilder confidence is crashing, housing starts and permits are plummeting and consumers are reeling from the general economic climate. Walmart (WMT) is now selling more food than apparel; more hot dogs than steaks.

As usual, I’m keeping an eye on the homebuilders, who incidentally held up fairly well in response to the Fed’s hawkish utterances as bond yields remained near their recent lows.

My favorite homebuilder stock remains DR Horton (DHI), which looks set to consolidate its recent gains. The stock is now in the midst of what looks to be a consolidation pattern after its recent recovery above its 200-day moving average. ADI and OBV remained stable, and there is good support all the way down to the $75 area.

Thus, if the bond market is correct, which is more than plausible, and the Fed is wrong, which is a historically accurate expectation, the central bank will go too far in its rate hikes. The economy could very well slow rapidly, which will likely prompt the Fed to resort to QE once again. And, cue the music, the stock trading algos will go into overdrive as they did in March of 2020.

On the other hand, if the FTX thing really unravels, the Fed may be forced to start QE sooner.

Welcome to the Edge of Chaos:

“The edge of chaos is a transition space between order and disorder that is hypothesized to exist within a wide variety of systems. This transition zone is a region of bounded instability that engenders a constant dynamic interplay between order and disorder.” – Complexity Labs

Editor’s note: This will be the final Market Summary for the month of November due to holiday scheduling for Thanksgiving. Subscribers will receive Portfolio Summaries as usual. Market Summary will resume on December 3.

NYAD Reverses. Liquidity Stumbles.

We are seeing a similar pattern to what we saw this summer when that rally ended, as NYAD has reversed while liquidity has rolled over and the put buyers are back. The market’s breadth is suggesting caution is in order. The New York State Advance Decline line (NYAD) has reversed its positive cross above its 50-day moving average and is now testing its 20-day line.

Meanwhile, the CBOE Volatility Index (VIX) is starting to move higher. When VIX rises, stocks tend to fall, as rising put volume is a sign that market makers are selling stock index futures in order to hedge their put sales to the public.

The Eurodollar Index (XED) rolled over and fell below 95. This is not a good development, as it suggests liquidity is once again drying up.

The S&P 500 (SPX) remains above its 50-day moving average, but can’t seem to get above the 4100 resistance level or its 200-day moving average. Accumulation Distribution (ADI) is starting to roll over, which means short sellers are sneaking in. On Balance Volume (OBV) is still showing some small signs of improvement, but if the shorts gain control OBV will roll over.

Critical support now lies at 3800-3900.

The Nasdaq 100 index (NDX) has been volatile, but is still stuck between the 11,000-12,000 trading range. ADI and OBV here remain worse than in SPX, where the energy stocks are exerting some upward pressure.

To get the latest up-to-date information on options trading, check out Options Trading for Dummies, now in its 4th Edition – Get Your Copy Now! Now also available in Audible audiobook format!

#1 New Release on Options Trading!

Good news! I’ve made my NYAD-Complexity – Chaos chart (featured on my YD5 videos) and a few other favorites public. You can find them here.

Joe Duarte

In The Money Options

Joe Duarte is a former money manager, an active trader and a widely recognized independent stock market analyst since 1987. He is author of eight investment books, including the best selling Trading Options for Dummies, rated a TOP Options Book for 2018 by Benzinga.com and now in its third edition, plus The Everything Investing in Your 20s and 30s Book and six other trading books.

The Everything Investing in Your 20s and 30s Book is available at Amazon and Barnes and Noble. It has also been recommended as a Washington Post Color of Money Book of the Month.

To receive Joe’s exclusive stock, option and ETF recommendations, in your mailbox every week visit https://joeduarteinthemoneyoptions.com/secure/order_email.asp.