Last week, I was listening to an analyst talking about small caps. He basically poo-poo’d their importance and therefore influence on the overall market conditions.

Now, this is our Granddad Russell (IWM) — the representative of stuff made in the USA.

He went on to say that IWM is not a good barometer, rather, we should be looking at the S&P 600. The index looks almost identical to IWM on the chart.

Be that as it may, Gramps does not live in the Economic Modern Family by himself. To be sure, Sister Semiconductors (SMH) lives there. So does Regional Banks (KRE).

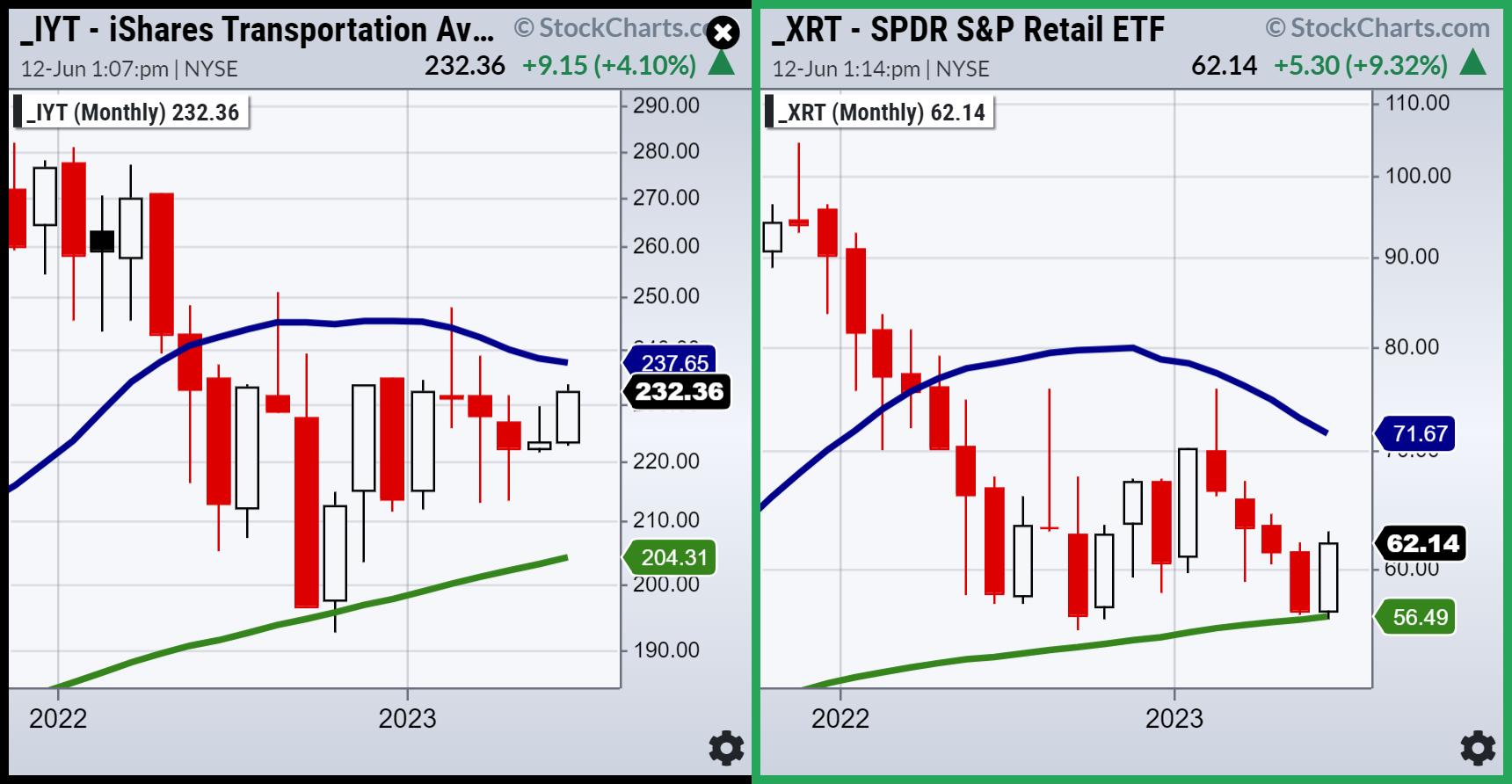

While SMH is well above its 23-month moving average, IWM is not. Nor is the Russell 2000 (IWM), shown to you over the weekend. And neither are Granny Retail (XRT) or Transportation (IYT).

Go ahead and make a case for small caps-but supply and demand as measured by these 2 essential family members? You have got to pay attention.

The 23-month moving average (blue) in both XRT and IYT remain elusive. Granted, Transportation (IYT) is closer, while Granny (XRT) just got a pass holding the 80-month MA (green). But now we have 2 pieces of evidence to add to our small caps.

ALL 3 ETFs by the way, directly correlated with the US economy.

This week, with CPI, PPI, Retail Sales and FOMC, watch our trio or what Stanley Druckenmiller once called the “inside” sectors of the US economy. We get through the 23-month MA in IYT, that’s great. We start to rollover, not so great. If XRT keeps up at the very least, great. If she rolls over and fails the 80-month, really really not so great.

Signs from the Family never fail to signal the next big moves in the market.

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

“I grew my money tree and so can you!” – Mish Schneider

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Mish Schneider and TG Watkins continue their chat about the business of trading in this video from StockCharts TV. Topics range from their work/home life balance, how being a consumer does or does not play into their trading decisions, and what they do in their free time to unwind.

Mish and Nicole Petallides go over rates, key sectors and the economy in this video from TD Ameritrade. They also discuss what raw materials are coming into vogue.

Mish and Jon talk about what could make markets continue or reverse and what to buy right now on BNN Bloomberg’s Opening Bell.

Mish and Charles talk inflation fears, the “wall of worry” and trading large-caps on Fox Business’ Making Money with Charles Payne.

The first 5 months of 2023 have been rallying on optimism going forward. Will that continue for the next few months? Mish digs into that question in this Twitter Spaces conversation with Wolf Financial.

Mish discusses impacts of weather, labor market and the FED on tap on Fox Business’ Coast to Coast with Neil Cavuto.

The US dollar rallied following a positive US jobs report last Friday, but could the Federal Reserve’s upcoming interest rate decision halt the greenback’s rise? Mish offers her views on USD/JPY, the S&P 500, and light crude oil futures on CMC Markets.

Mish talks GME (Gamestop) and more on Business First AM.

Where is the US economy actually heading? Rajeev Suri of Orios discusses this question and what trends suggest with Mish in this video.

Mish joins Rajeev Suri of Orios Venture partners to discuss the Fed, inflation, and buybacks in this video on LinkedIn.

In this episode of StockCharts TV’s ChartChats, Mish Schneider and TG Watkins (creator of the Moxie Indicator) sit down for a candid chat about working with other StockCharts contributors. Learn what TGs strategy for trading is, and how the the Moxie Indicator came to be. Mish shares her background and how she got started in the industry.

With Congress having reached a deal after months of debt ceiling talks, what direction could the US dollar move in, and what could this mean for the USD/JPY? Mish explores the market movements in this appearance on CMC Markets.

Mish joins Rajeev Suri of Orios Venture partners to discuss the trend toward a risk-on situation in this video on LinkedIn.

Mish weighs in on the overnight slump across the board on the benchmarks and where the momentum is heading on Singapore Breakfast, available on Spotify.

Mish explains how reversal patterns could come to the fore this week in this appearance on CMC Markets.

Mish joins Rajeev Suri of Orios Venture partners to discuss the possibility of economic stagflation in this video on LinkedIn.

Mish discusses how AI is being used to invest in this article for BNN Bloomberg.

Coming Up:

June 13: Daily Briefing on Real Vision

June 14: CMC Live Trading in London 1:30 ET

June 22: Forex Premarket Show with Dale Pinkert

June 23: Your Daily Five on StockCharts TV

ETF Summary

S&P 500 (SPY): We took out the August 2022 high 431.73 — now must hold.Russell 2000 (IWM): 180 — now must hold while still miles from its 23-month MA of 193.Dow (DIA): 23-month MA 337 cleared, 340 next big level.Nasdaq (QQQ): Do we hear 370?Regional Banks (KRE): Red today and yet holding, 42.00 now support.Semiconductors (SMH): 151.71; if clears probably means another leg higher.Transportation (IYT): 237 area the 23-month moving average.Biotechnology (IBB): 121-135 range.Retail (XRT): 60 now support and 63 resistance.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education