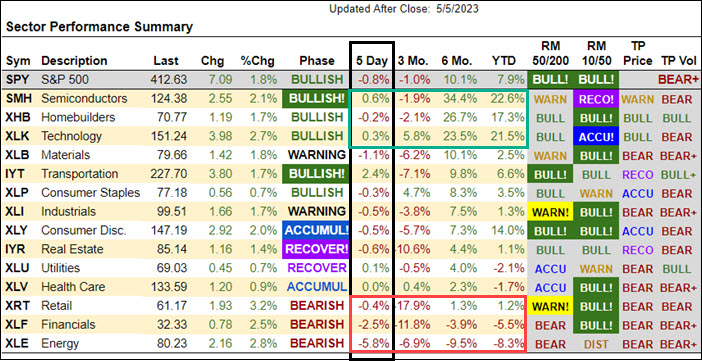

Today, I’ve got a handful of bullish stock charts for your watchlist next week, the importance of which begins with the table shown above. You can find this Sector Summary table updated daily at www.marketgauge.com/sectors.

If you were watching the market last week, it probably didn’t feel cal or uneventful. However, as you can see from the “5 day” column highlighted in the Sector Summary table above, the end result was relatively unchanged in most sectors.

One notable pattern, also highlighted, is that the top 3 sectors based on 6-month percent change were also the better performers for the week and on Friday. Likewise, the worst performing sectors for the week are also the worst performers over the last 6 months and year-to-date. This pattern of the relatively strongest groups or stocks continuing to outperform while the laggards continue to lag is a well known tendency of the market that we exploit in several of our trading systems.

In recent Mish’s Daily articles, I’ve suggested that gold was poised to move higher, and the semiconductor sector ETF (SMH) was weak and likely to break below its 50-day moving average and decline.

Leading up to the employment report on Friday, gold was rallying and SMH was rolling over. However, the report suggested that the economy was stronger than expected, which pushed the stock indexes and the semiconductor sector (SMH) higher. If it trades back over $125, its pattern will turn bullish.

At the same time, gold gapped down on Friday, then rallied though out the day. Is the gap down in gold a dip to buy or a significant top? Will SMH break higher?

In both cases, a move over Friday’s high would be a good reason to look at long trades in the ETFs or in leading stocks in their respective groups.

Here are a few gold stocks that have bullish patterns.

These stocks are in bullish patterns as long as they stay over their 10-day moving average (red line).

Here are some bullish semiconductor stocks

Warning: The semiconductor group is risky. It still needs to trade higher to confirm the resumption of its bullish trend. If any of these stocks or the SMH trade below last week’s low, it would be very bearish. However, if QQQ breaks out and SMH breaks over $125, these stocks could be market leaders.

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

IT’S NOT TOO LATE! Click here if you’d like a complimentary copy of Mish’s 2023 Market Outlook E-Book in your inbox.

“I grew my money tree and so can you!” – Mish Schneider

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Mish explains why Grandma Retail (XRT) may become our new leading indicator on the May 4th edition of Your Daily Five.

Mish and Dave Keller discuss why Mish believes that yields will peak in May, what to expect next in gold, and more in this in-studio appearance on StockCharts TV’s The Final Bar!

Mish discusses the FOMC and which stock she’s buying, and when on Business First AM.

Mish covers strategy for SPY, QQQ, and IWM.

Mish and Nicole Petallides discuss cycles, stagflation, commodities and some stock picks in this appearance on TD Ameritrade.

Mish talks movies and streaming stocks with Angela Miles on Business First AM.

Mish and Charles discuss zooming out, stagflation and picks outperforming stocks in this appearance on Making Money with Charles Payne.

We all know at this point how difficult the market has been with all of the varying opinions regarding recession, inflation, stagflation, the market’s going to come back, the market’s going to collapse – ad nauseam. What about the people stuck in the middle of a range bound market? Mish presents her top choices for shorts and longs on the Friday, April 21 edition of StockCharts TV’s Your Daily Five.

Mish and Benzinga discuss the current trading ranges and what might break them.

Mish discusses what she’ll be talking about at The Money Show, from April 24-26!

Mish walks you through technical analysis of TSLA and market conditions and presents an action plan on CMC Markets.

Mish presents two stocks to look at in this appearance on Business First AM — one bullish, one bearish.

Mish joins David Keller on the Thursday, May 13 edition of StockCharts TV’s The Final Bar, where she shares her charts of high yield bonds, semiconductors, gold, and regional banks.

Mish joins Wolf Financial for this Twitter Spaces event, where she and others discuss their experiences as former pit traders.

Mish shares her views on natural gas, crude oil and a selection of ETFs in this appearance on CMC Markets.

Mish talks what’s next for the economy on Yahoo! Finance.

Mish joins Bob Lang of Explosive Options for a special webinar on what traders can expect in 2023!

Rosanna Prestia of The RO Show chats with Mish about commodities, macro and markets.

ETF Summary

S&P 500 (SPY): 23-month MA 420.Russell 2000 (IWM): 170 support, 180 resistance.Dow (DIA): Over the 23-month MA-only index.Nasdaq (QQQ): 329 the 23-month MA.Regional banks (KRE): 43 now pivotal resistance.Semiconductors (SMH): 246 the 23-month MA.Transportation (IYT): 202-240 biggest range to watch.Biotechnology (IBB): 121-135 range to watch from monthly charts.Retail (XRT): 56-75 trading range to break one way or another.

Geoff Bysshe

MarketGauge.com

President