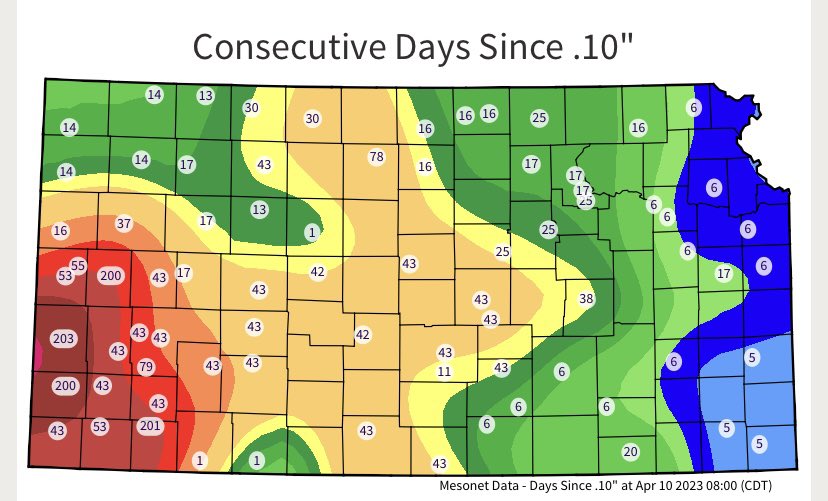

The chart shows how many days have passed since any significant rain in the major crop growing regions in the U.S.

Initial yield estimates for this year’s U.S. winter wheat crop have been hammered by persistent drought. 12 Southwest Kansas counties dominate the area of drought. Wheat, corn, and oats are the major crops. Yet the futures prices do not reflect these growing (pun intended) concerns.

Part of the reason is that Russia, the main exporter of wheat, is selling the grain at a huge discount.

However, a couple of weeks ago on March 28th, we featured the agricultural ETF DBA as a buy opportunity. And over this past weekend, our Market Outlook mentions that one huge risk off indicator is that the “Soft Commodities (DBA) made a golden cross right as they are running into multi-month technical resistance and are already at potentially overbought levels on both price and momentum. according to Real Motion. However, if DBA takes out the $21 level, then it would signal a breakout of a multi-year base.”

So here we are with drought, technical resistance, and another very low risk entry for wheat or WEAT the ETF.

Over the weekend, we wrote about Regional Banks (KRE) as a potential double bottom and key to this data-heavy week. As a side note, KRE remained green on Monday. Another push higher, and many of the picks from the weekend’s Daily should also work out.

Back to mother nature, though — 2 charts and 2 distinct perspectives. The chart on the left is of WEAT, the ETF for wheat futures. In a daily timeframe, it is in a bearish phase. Nevertheless, it is holding the March low and, through the cyan line, could set up for a long with a very good stop point.

DBA, in a strong bullish phase, now has 2 tops at 20.75 (today and in February). Should that clear, 22.00 is the next target.

Finally,

Join Mish along with Bob Lang from Explosive Options for a strategy session for 2023!

When: Tuesday, April 11Time: 4:30 ET

Click here to reserve your seat now!

In this presentation, you’ll discover Mish and Bob’s outlook on:

Recent events that have affected the markets – and their long-term impacts;What we might expect from the Fed’s monetary policy and interest rate hikes this year;The world of commodities;And most importantly: How to approach trading for the remainder of 2023.

Bring your questions, because these sessions are rare, interactive, and lively!

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

IT’S NOT TOO LATE! Click here if you’d like a complimentary copy of Mish’s 2023 Market Outlook E-Book in your inbox.

“I grew my money tree and so can you!” – Mish Schneider

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Mish and Charles Payne rip through lots of stock picks in this appearance on Fox Business’ Making Money with Charles Payne.

Mish talks Beyond Meat (BYND) in this appearance on Business First AM.

In this guest appearance on the Madam Trader podcast, recorded March 20, Mish shares her journey from special education teacher to commodoties trader and now trading educator. Hear her insights on the spring 2023 market conditions and how to harness the right skills to succeed.

Follow Mish as she breaks down current market conditions for her friends across the pond on CMC Markets.

Mish talks about Dominion Energy with Angela Miles in this appearance on Business First AM.

Coming Up:

April 11th: Webinar with Bob Lang and Twitter Spaces with Mario Nawfal (8am ET)

April 13th: The Final Bar with David Keller on StockCharts TV and Twitter Spaces with Wolf Financial

April 24-26: Mish at The Money Show in Las Vegas

May 2-5: StockCharts TV Market Outlook

ETF Summary

S&P 500 (SPY): 405 support and 410 pivotal.Russell 2000 (IWM): 170 support, 180 resistance still.Dow (DIA): Through 336.25 could go higher.Nasdaq (QQQ): 325 resistance, 314 10-DMA support.Regional banks (KRE): 41.28 March 24 low held, now has to clear 44.Semiconductors (SMH): 247 is the most significant support.Transportation (IYT): Held weekly MA support and now must clear 224.Biotechnology (IBB): Great job changing phases to bullish, but must confirm over 130.Retail (XRT): Don’t want to see this break under 59.75; best if clears 64.50.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education