Markets are absorbing the news of another bank failure this morning. As the financial industry starts to wobble with the fallout from the sudden change in interest rates, it is more important than ever to protect capital.

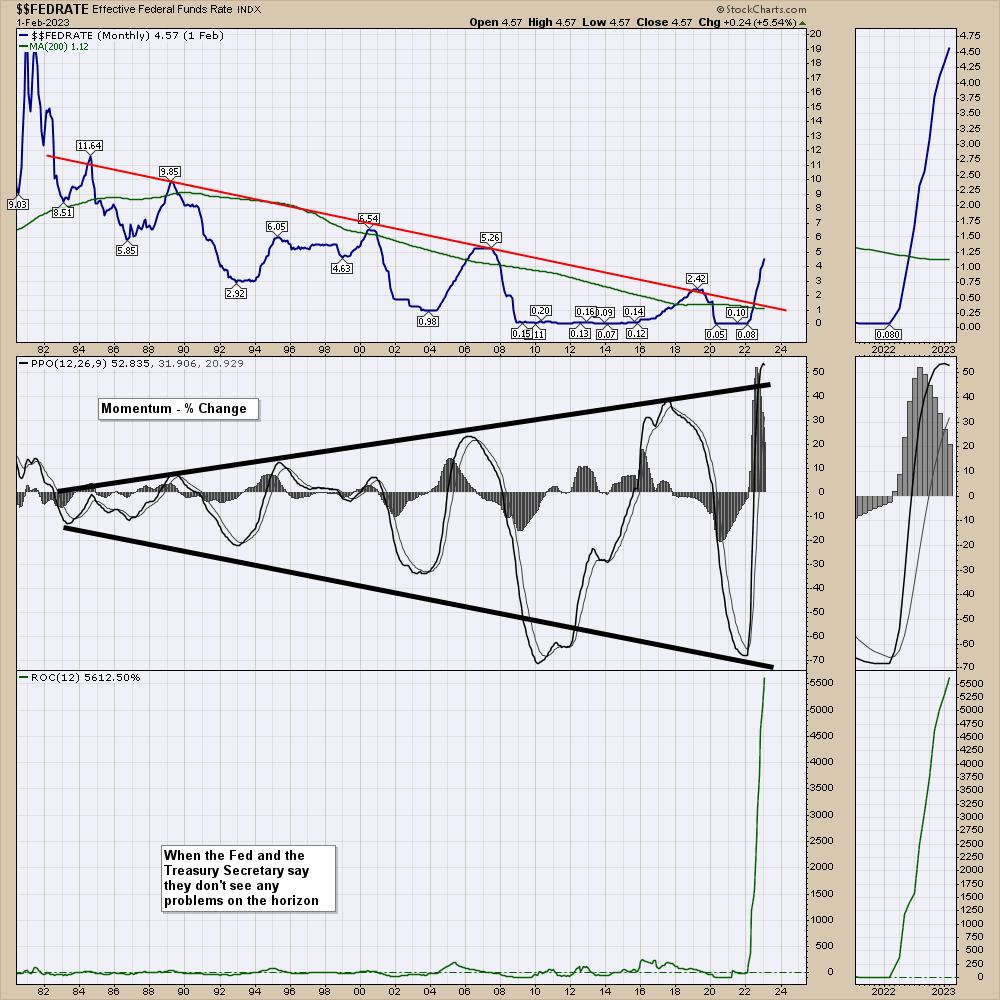

This is my goto chart about the change in interest rates. The Fed is expected to raise rates in the coming weeks.

The top panel is the current Fed Funds Rate. The terminal rate is expected to be above the 2007 highs.

The middle panel is the momentum of the Fed rate changes. What is important for me, is it seems that each one of these swings is wider and higher than before. If this was a crankshaft, we are getting wobbly or wobblier might be a better way to say it. As well, notice the vertical move recently on the PPO. This is all in one year, compared to the period after the great financial crisis taking 8 years to move from low to high.

The bottom panel is the current rate of change. By far, the fastest rate of change. As we have seen two banks fail in the last few weeks, will we start to see more contagion? Janet Yellen mentioned she has multiple banks on her watch list right now.

Since the beginning of the year, we have seen both SI and SIVB cease. We have also watched the demise of FTX. But each issue seems to wobble the market but not break it. That’s the good news.

Here is the last chart of SIVB. The final SCTR top for SIVB was in October 2021. The final price high was at the top of the $NDX in November 2022. In under 16 months, the bank was wiped out.

Here is the chart of SI. Silvergate went public in 2019. After a euphoric move into November 2021, the stock made a series of lower lows and lower highs, dropping from $240 to $2.75 in 16 months.

As this market continues fighting off bad news, this becomes an important week to keep in mind.

I discussed the tender situation for the $SPX on Market Buzz Wednesday. Here is a link to the recording.

I’ll also be hosting an information session about protecting capital and taking advantage of bull market runs on March 14th, 2023 at 11:00 AM. Register here to get free access to the live event.

The charts broke long before the companies did. Buying stocks with weak SCTR rankings in industries like finance is part of the problem. Charts give us more information in one picture than all the CEO interviews over the past few years. What investors do with their money relative to the stock is more important than the CEO’s comments in my opinion.