Most stocks in the S&P 500 have reported 3rd quarter results and, while a lower-than-average number reported above estimates, many that had positive results have gone on to trade higher in moves that still have further upside during the current bear market rally.

The biggest winners among these companies reporting positive earnings were stocks that immediately posted a gap up in price on high volume, which then led to a base breakout. This is one of the most powerful chart patterns and often will lead to further gains that are much higher than the markets.

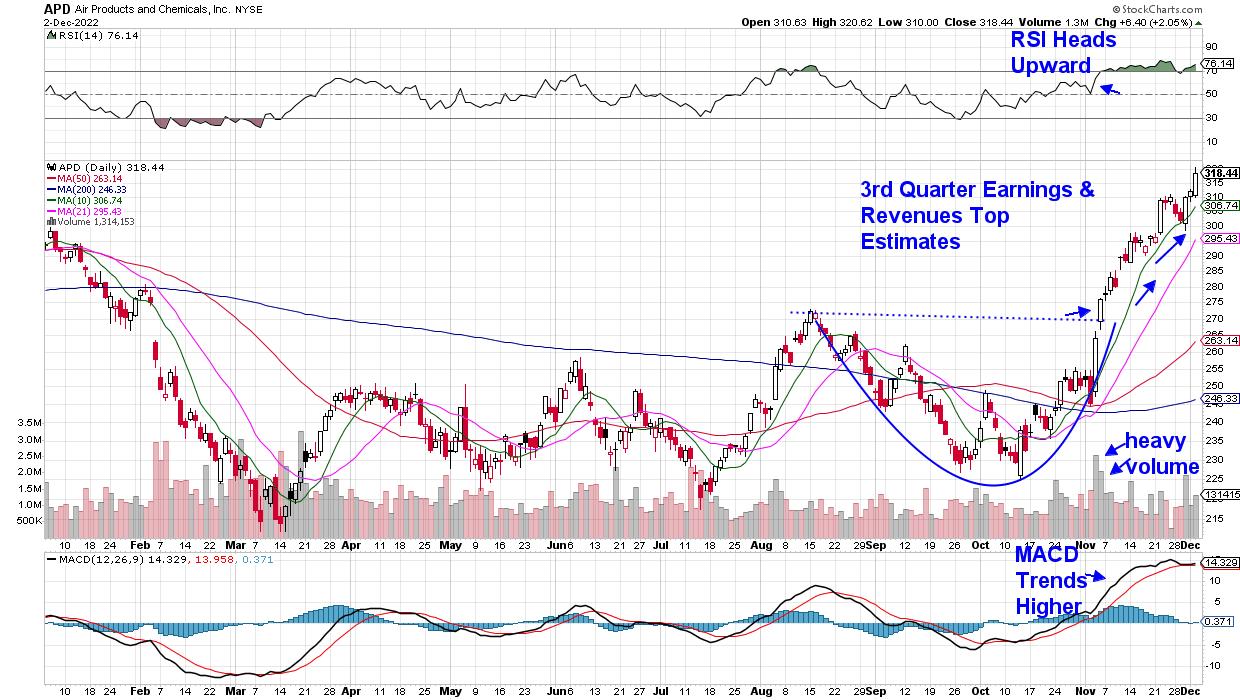

DAILY CHART OF AIR PRODUCTS AND CHEMICALS, INC.

To begin, the higher-than-average volume during the gap up in price indicates strong demand for the stock that, in most cases, will take more than one day to fulfill. One reason for the strong demand is strong earnings, which has been proven to be the primary driver of stocks that go on to far outpace the markets.

Over the days following the better-than-expected earnings report, Wall Street analysts will often begin to raise their price target for the stock — which was the case for Air Products & Chemical (APD) — and this will provide a secondary boost. The latest price target upgrade for APD is $390, which is 18% above the current price.

Of course, these stocks won’t go on to trade higher forever. Your first signal that the uptrend is over will be a move of the RSI into negative territory (below 50) on the daily chart. Price action within the broader markets will impact these leading stocks as well.

DAILY CHART OF FIVE BELOW, INC. (FIVE)

Above is a chart for Five Below (FIVE), which gapped up into a base breakout last Thursday after reporting earnings that were 93% above estimates. In addition, management raised their guidance going into year-end due to robust holiday sales. In turn, Wall Street raised their price target to $200, which is about 10% above its current price.

Five Below’s supersized rally pushed the stock out of a 5-month base, which is constructive, as the longer your base breakout, the longer your possible advance out of that base.

Strong earnings are not the only reason that stocks gap up into base breakouts, as one of the Biotechnology stocks from my MEM Edge Report has just entered an uptrend out of a base due to positive clinical trial news for one of their drugs. In addition, the company is estimated to grow earnings by 207% next year. To receive immediate access to this stock that is just beginning to trend higher, use this link here for a 4-week trial at a nominal fee. You’ll also have access to my other top picks.

In addition, my bi-weekly MEM Edge Report provides insights into what to expect for the markets going into year end as well as which areas of the market you should overweighting. Take advantage of this offer now!

Warmly,

Mary Ellen McGonagle, MEM Investment Research